Industry

Services

Banking &

Financial Services

Services

Digital Media

Planning & Buying

Analytics &

Insights

Campaign Objective/ Client Brief

Sundaram Mutual, leading AMC partnered with Social Beat to create multiple digital campaigns to increase Brand’s visibility. Through our optimized NFO campaigns in the past, we garnered over 80 million impressions. The idea was to re-engage with this audience via display campaigns with solution centric ads rather than product focused ones. These solutions were based on the common financial goals people usually have. The thing about goals is that they are different for different people. So both our creatives and targeting had to be tailor-made for each goal and audience type.

The objective of this campaign was also to influence people to make investments online using relatable personas of people with goals like planning their child’s education or retirement and projected mutual funds as a solution through Google display advertising.

Creative Approach

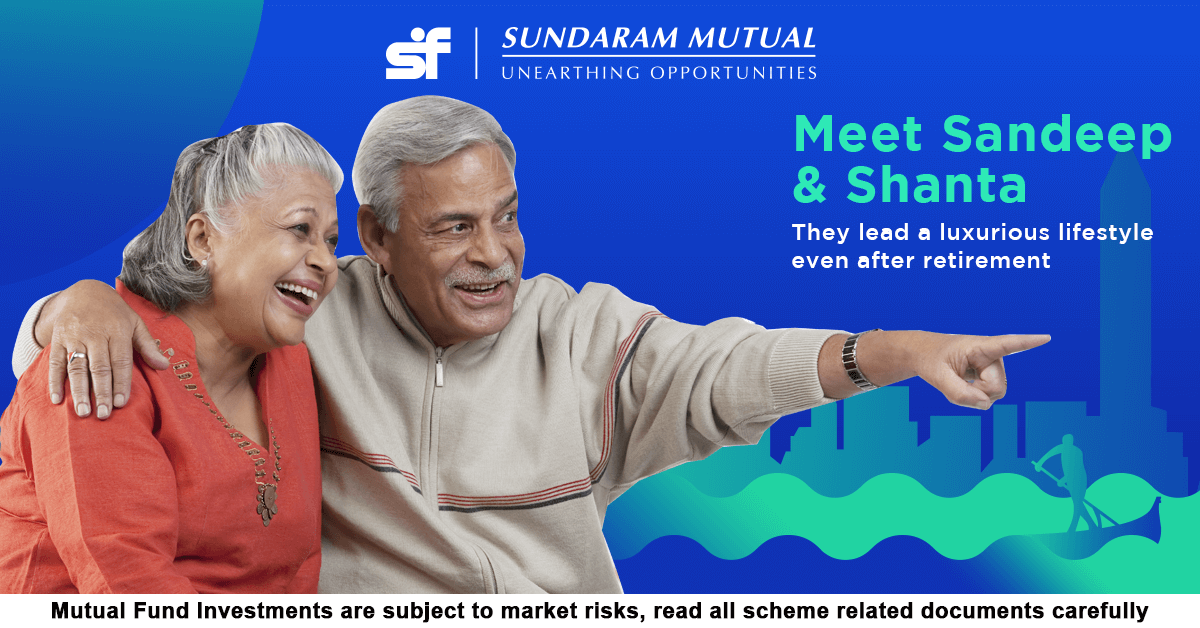

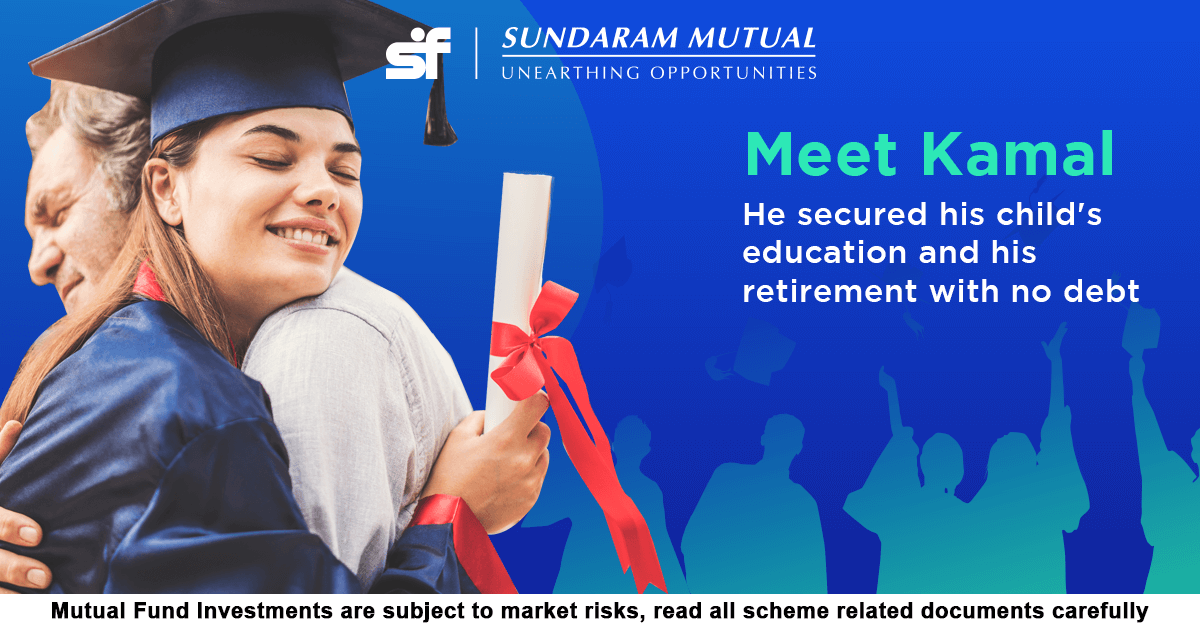

In terms of our creative approach, we used Brand Colours with a Vector + Image approach. We moved away from Fund specific creatives for better relatability and recall. The visuals we had in place were focused on the end solutions, like travelling, retirement, child’s education or even buying a car rather than the process of investing or abstract growth. We also started the copy with Meet Neha or Meet Kamal as this would increase the curiosity among the audience to click on the ad redirecting them to the goal-focused landing page.

Display Strategy

We used custom audiences, topics, placements and demographics targeting like age, gender, household income and parental status to display each ad only to users that would relate to it, for example for Kamal who was planning his child’s education and retirement we targeted only parents of the age 35-54 and created a custom audience of people using child education calculators and child education investment plans and for Neha who likes traveling we targeted users of age 18-24 and travel buffs, enthusiasts and investment, competitors but only on travel related placements and topics.

We used non last click attribution for the campaigns to attribute the prior touchpoints before the final conversion and not just the last touchpoint and optimize campaigns and allocate budgets accordingly.

We started the campaigns with eCPC and then moved to Target CPA once we had enough conversion data to reduce the CPL. We also leveraged the brand visibility and awareness from the NFO and used those audiences for the campaigns and drove them to the bottom of the funnel.

We also used campaign and creative level UTM parameters to track the quality of the leads and allocate budgets accordingly and

also added audiences to search campaigns to get insights on which audiences converted on search.

This way, we added much-needed context to a space like mutual funds and investing which is considered slightly intimidating.

Optimized Landing Pages

We leveraged goal-focused landing pages highlighting benefits of Mutual Funds, along with a display of relevant schemes for visitors to invest to accomplish goals.

Creative Approach

In terms of our creative approach, we used Brand Colours with a Vector + Image approach. We moved away from Fund specific creatives for better relatability and recall. The visuals we had in place were focused on the end solutions, like travelling, retirement, child’s education or even buying a car rather than the process of investing or abstract growth. We also started the copy with Meet Neha or Meet Kamal as this would increase the curiosity among the audience to click on the ad redirecting them to the goal-focused landing page.

Display Strategy

We used custom audiences, topics, placements and demographics targeting like age, gender, household income and parental status to display each ad only to users that would relate to it, for example for Kamal who was planning his child’s education and retirement we targeted only parents of the age 35-54 and created a custom audience of people using child education calculators and child education investment plans and for Neha who likes traveling we targeted users of age 18-24 and travel buffs, enthusiasts and investment, competitors but only on travel related placements and topics.

We used non last click attribution for the campaigns to attribute the prior touchpoints before the final conversion and not just the last touchpoint and optimize campaigns and allocate budgets accordingly.

We started the campaigns with eCPC and then moved to Target CPA once we had enough conversion data to reduce the CPL. We also leveraged the brand visibility and awareness from the NFO and used those audiences for the campaigns and drove them to the bottom of the funnel.

We also used campaign and creative level UTM parameters to track the quality of the leads and allocate budgets accordingly and also added audiences to search campaigns to get insights on which audiences converted on search.

This way, we added much-needed context to a space like mutual funds and investing which is considered slightly intimidating.

Optimized Landing Pages

We leveraged goal-focused landing pages highlighting benefits of Mutual Funds, along with a display of relevant schemes for visitors to invest to accomplish goals.

Creatives

Results

Higher impact at

a lower cost

A more engaged

audience

32% decrease in

CPL

26% qualified leads

were contactable

and interested

91% increase in

conversion rate

39% increase in

CTR

Using this Google Display ad feature on a strategic and tactical level has helped improve the Brand's visibility to a great extent and there is definitely much better ROI.