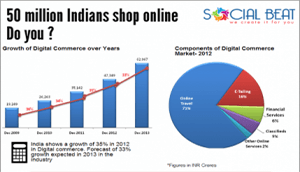

The digital commerce market in India was valued at INR 47,349 Crores in 2012 and is expected to grow by 33 percent. It is undoubtedly the fastest growing online market in the last 12 months when compared with the other BRIC Countries. According to the latest Digital Commerce Report, by the Internet and Mobile Association of India (IAMAI) and IMRB International.

The report finds that while Online Travel, which includes booking rail, air, bus tickets, hotel accommodations and tour packages comprised a majority 71 percent of the whole Digital-Commerce market in 2012,E-Tailing, which includes purchases of various consumer products/services such as electronics, apparels, footwear, jewellery, home & kitchen appliances, consumer durables, furnishings, constituted only 16 percent of the overall share. This is the segment which all ecommerce companies including Amazon India are trying to target.

Financial Services, which include services such as paying insurance premiums and renewals, paying utility and mobile bills, trading shares and securities amounted to 6 percent of the overall share. B2B and B2C Classifieds (jobs, matrimony, car, real estate etc.) contributed 5 percent, whereas other online services such as online entertainment ticketing, online food delivery, buying discounts/deals/vouchers etc. constituted 2 percent of the overall digital commerce market in 2012.

With more and more people planning their payments and Financial services online, market was valued at INR 2,886 Crores in 2012 and is expected to grow by 25 percent and reach to INR 3,607 Crores by the end of year 2013. According to the report, Classifieds market has seen a significant growth and has reached INR 2,354 Crores in 2012. Classifieds as a category has grown with a CAGR of 45 percent growth from 2009 and is expected to grow by another 30 percent to INR 3,061 Crores by 2013.

Online travel industry in India has on an average grown by 32 percent from INR 14,953 Crores in 2009 to INR 34,544 Crores in 2012 and is estimated to grow by another 30 percent and be valued at INR 44,907 Crores by the end of December 2013. The travel industry also sees interesting fact about the average cart value of goods purchased ranging from 17$ in IRCTC to about 204$ and 166$ in Make my trip and Yatra.com respectively.

The E-Tailing category has grown from INR 1,550 Crores in the year 2009 to INR 6,454 Crores in year 2012. With the entry of the world’s largest online retailer, Amazon through the launch of its online marketplace in India, Amazon.in and hundreds of start ups emerging, this category is estimated to grow by 55 percent and cross INR 10,000 crores by the end of 2013 December.

India represents Amazon’s tenth marketplace where buyers can browse through a catalogue of 7 million books and 12,000 movies titles initially. The company is planning to expand its product footprint to cameras, mobiles and other electronics devices.

With the Digital commerce market having so much to offer to the country, one could only see internet and Ecommerce reaching not just the metropolitans and the major cities in India but also hitting the Indian Villages soon. Of course, it comes with its humongous set of challenges forcing even Flipkart to follow a marketplace (no-inventory) model. For now, its time to watch the big players battle it out in the ecommerce market